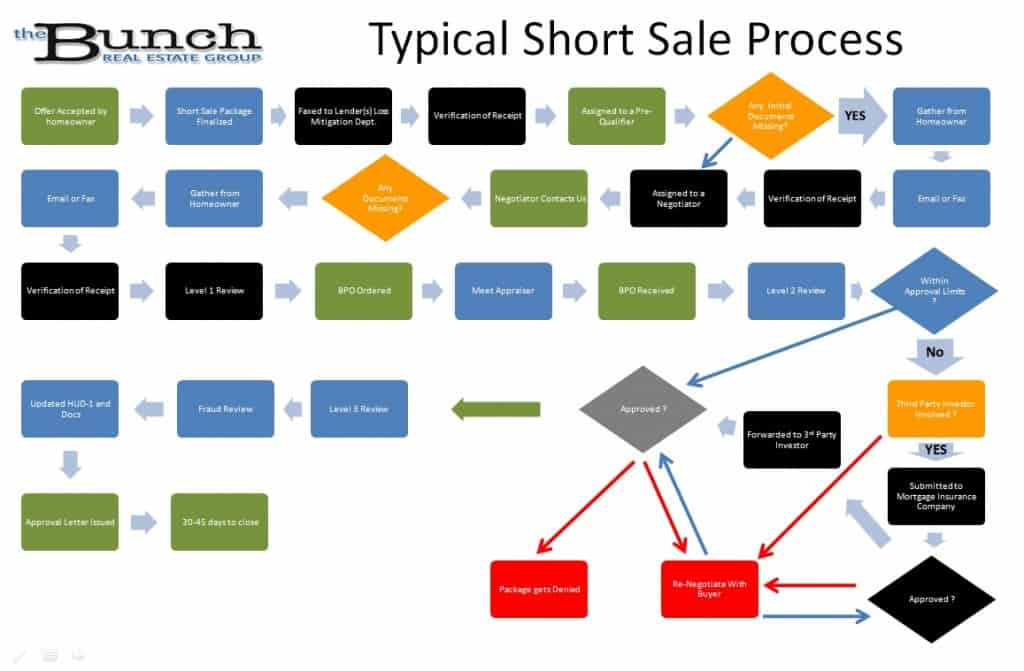

If you are looking to get a deal on your next home, you may be wondering what Buying a Short Sale is going to feel like. Well, it is going to feel like you have no control. However, the presumption is that at the end of this you will be rewarded with a great property at a below market price. The process is straightforward but it relies heavily on the owner’s hardship, their honesty and their lender’s independent assessment of current market value. Which means…the homeowner and the listing agent need to be organized and on top of their game because your success depends on it. In the end, if the the short sale is to be approved the owner will have to convince the lender that the property will go into foreclosure regardless of whether the short sale is approved or not. And, that the contract submitted for their approval will be the least costly way to dispose of the property. The figure below outlines the general path to short sale approval.

THE HOMEOWNER / SELLER:

Once a homeowner realizes that there is no way to continue making payments on their loan, there are only a handful of options:

- Seek to modify their loan to achieve a lower payment. The statistics on this are not encouraging long-term though. Loan modifications usually only last about a year because the underlying distress is larger than a marginally lower payment can make up for.

- Seek a real estate agent who is a Certified Distressed property Expert (CDPE) and work to get a Short Sale approved. As a CDPE it is hard for me to imagine not at least trying this route. If successful, the homeowner’s credit is impacted less than a foreclosure, the debt many times is forgiven and it shows good faith in helping to make the best of a bad situation.

- Offer the lender the deed to the house back (Deed in Lieu of Foreclosure). The lender will only consider this if they belioeve the property is worth close to or more than what is owed. Otherwise it makes no sense to let the homeowner off the hook and take back the property just to have to sell themselves it at a huge loss.

- Stop paying and let the home go into foreclosure. Sadly, Homeowners go down this path sometimes out of ignorance or because of embarrassment. Either they do not know the options OR do not want their friends and neighbors to know their situation buy putting the house on the market as a short sale. I use the word sad because if the distress is real, help is available. Close friends and trusted professionals can at least reduce the feeling of helplessness and isolation in a very difficult and emotional time.

THE BANK:

The Lender is basically the judge who needs to be convinced. The homeowner and their real estate agent make their case and answer questions until a decision is rendered. The stronger and more convincing the case – the more likely the Lender is to approve the short sale.

LIST PRICE:

Our strategy regarding the list price is geared to start at the likely market value for the neighborhood, condition and features. Then, systematically reduce the price as necessary to obtain an acceptable offer from a qualified buyer who is willing to stay with the process for at least 120 days. The whole goal is to demonstrate a genuine effort to obtain the highest sale price with full-time credible marketing, showing data, showing feedback and price adjustments only the extent necessary to obtain an offer. When mortgage payments are NOT being made, the clock is ticking and foreclosure is looming. Price reductions are made about every two weeks in those cases – which is plenty of time for the market to respond.

TIMING:

All parties need to realize that neither Listing Broker/Agent nor Selling Broker/Agent can guarantee a specific date or time response from the bank, nor guarantee approval of and specific offer or terms. The Buyer is advised to discuss the nature of the transaction with their lender to discuss common concerns in financing properties sold in this manner. After the Seller’s lender(s) receives the short sale packet, their lender(s) may require at least 60 – 90 days to approve the short sale. After approval, the sale will have to close within lender approved time frame, typically 25 – 40 calendar days but a shorter time window could be imposed. The possibility does exist that this property could be sold at a foreclosure auction in spite of the efforts being taken under a contract for short sale.

LENDER TERMS:

Quite often there is a complex negotiation between Seller and their lenders as to the precise terms of the release(s) and short sale approval is not assured. After the contract is signed, Seller’s lender(s) may impose other obligations and restrictions on Buyer and Seller including but not limited to Seller’s net funds to close, financial contributions, and other matters which relate to the amount of funds available to lender to satisfy the debt which may require the parties to renegotiate or cancel the transaction. One thing is for sure – the seller will be netting $0.00 in any short sale and in some instances may be required to make some sort of good faith payment to the lender in exchange for approval.

CLOSING DATE:

The closing date is really just an estimate. The actual Closing will take place on or before the date set by the Lender in their written acceptance of short sale. All parties will need to acknowledge that this may require that the closing happen earlier than the closing date stated in their contract. Everyone has to be flexible and this will require a very responsive lender if the buyer is getting a loan.

PROPERTY CONDITION:

This Property is almost always being conveyed in “As-is” condition at the time of closing. The Seller may not make any repairs and may be unable to pay for maintaining the property. It is important to make sure that the Seller agrees to not make any alterations to the property following the acceptance of this agreement that would reduce its value (like removing fixtures). Buyer also needs to realize that conditions at the property may change and needs to take on some responsibility monitoring the property as they deem necessary. If the condition of the property worsens substantially during the time between acceptance of the contract and the date when written approval is received from the lender(s), Buyer needs to make sure they can opt to seek relief from the lender(s). The lender(s) will be under no obligation to fix anything and may do nothing so the buyer needs the ability to terminate the agreement if they don’t.

PROPERTY TAX PRORATIONS:

Seller and Buyer will have to agree that the proration of taxes at closing will be based on the most recent bill issued by the appropriate taxing authority and may not be the final bill for the current year. All prorations at closing will be final and there will be no further adjustment after closing between Buyer and Seller.

UTILITIES:

Buyers should know that utilities may not be on at the property. If any utilities are necessary to complete Buyer’s Due Diligence, establishing service for said utilities will probably be the sole responsibility of Buyer, and at Buyer’s expense.

INSPECTIONS:

Buyers should obtain property inspections, including but not limited to: roof and systems, appliances, engineer’s inspection if applicable, radon, septic, stucco, lead paint and wood infestation inspections. Buyers should probably also obtain enhanced owner’s title insurance in addition to seeking the advice of legal counsel for review of contracts and addenda, and review of title work.

RISKS:

Buyers assume certain risks associated with a short sale purchase. Typically buyers will be asked to waive and release any and all claims and shall hold harmless Listing Broker and Agents for loss or damage suffered in connection with the attempted or completed purchase of a short sale, including but not limited to costs and delays to Buyer, and expenses which may arise should the property be withdrawn from the market, foreclosed or not close within desired time frames.

QUESTIONS:

If you have questions about a specific situation or the short sale process, please feel free to email us at mb@michaelbunch.com