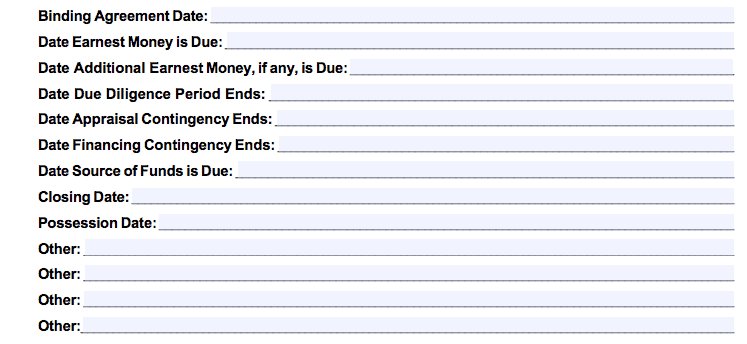

Here’s What to Expect with the Contract Deadlines

Deadlines drive the process once the contract is Accepted and Binding. The above dates are typical milestones in the home buying process. If you are the Buyer, this is YOUR show and your team needs to hit their marks so your Earnest Money is not put at risk. The explanations below have been prepared based on the 2015 version of the Georgia Association of Realtors (GAR) residential real estate contract forms.

Deadlines, Days and Times of Day

- Offers have Time Limits – Contracts have Deadlines.

- Contract Deadlines are measured in Days – which end at midnight.

- Contract Days are Calendar Days unless otherwise specified in a Special Stipulation. Business Days are very hard to define.

Binding Agreement Date:

The Binding Agreement Date is the date when an offering party receives written confirmation of the other party’s total acceptance of the presented offer terms with no changes. The keys here are:

- Written Confirmation

- Total Acceptance with NO CHANGES

If anyone is making changes, you are still in the counter offer process. Until there is a set of offer terms that gets accepted by the other party without change AND within the Time Limit of Offer, there cannot be an Accepted Contract. Once this happens, that Accepted Contract becomes Binding when both Buyer and Seller have copies of the final accepted terms and the last person to receive their copy writes in the Binding Agreement Date. The Acceptance Date and the Binding Agreement Date do NOT have to be the same day.

The Binding Agreement Date is Day 0 (zero). In order to give specific Contract Deadlines, we will assume the Binding Agreement Date is the 2nd.

Date Earnest Money is Due:

This date is typically specified as a certain number of days from the Binding Agreement Date. If this number is 2 days, then the Earnest Money is due before midnight on the 4th. Failure to provide this could constitute Default.

Source of Funds is Due:

This date is typically specified as a certain number of days from the Binding Agreement Date. If this number is 5 days, then the Earnest Money is due before midnight on the 7th.Failure to provide this could constitute Default.

Due Diligence Period Ends:

This date is specified as a certain number of days from the Binding Agreement Date. If this number is 10 days, then the Due Diligence Period expires at midnight on the 12th. So, what happens at 12:01am on the 13th? The Buyer is deemed to have accepted the property “as-is” AUTOMATICALLY. This means there will be inspections, negotiations and contractor estimates going on prior to this deadline to come to an agreement regarding property condition. If no agreement is reached prior to the expiration if the Due Diligence Period, the Buyer can either send Seller written notice of termination or be willing to accept the property “as is” (in which case the Buyer does not need to take any action).

In builder and relocation contracts, this process will probably be different. Check the specific language in your contract.

Appraisal Contingency Ends:

This date is specified as a certain number of days from the Binding Agreement Date. If this number is 18 days, then the Appraisal Contingency expires at midnight on the 20th. So, what happens at 12:01am on the 21st? The option to ask the seller to reduce the price down to an appraised amount lower than the Purchase Price is forfeited. In order to request an adjusted Purchase Price from the Seller as a result of the appraisal, a written amendment making such request must be submitted to the Seller along with the appraisal PRIOR to the deadline.

If you are the Buyer, make sure your lender gets the appraisal back in time to submit an amendment to the Seller if necessary. The Seller does not have to grant an extension and you do not want to be forced to beg for one.

Financing Contingency Ends:

This date is specified as a certain number of days from the Binding Agreement Date. If this number is 21 days, then the Appraisal Contingency expires at midnight on the 23rd. So, what happens at 12:01am on the 24th? The option to get out of the contract due to loan denial is forfeited. In order to terminate the contract as a result of loan denial, a written letter citing the reason(s) for loan denial must be received from the Lender and submitted to the Seller PRIOR to the deadline.

If you are the Buyer, make sure your lender gets the loan approval from Underwriting with some time to spare. More importantly, if your loan is going to be denied, make sure your lender issues a complete and conforming loan denial letter BEFORE the deadline so it can be submitted to the Seller. The Seller does not have to grant an extension here and you do not want to be forced to beg for one.

Closing Date:

Closing Dates are not suggestions or “on or before” dates (unless specified as such). There is language in the contract that allows for an adjustment if the date specified in the contract falls on a weekend or bank holiday (yes, in the heat of the moment this can happen).

Possession Date:

This is usually stated as a specific date or “At Closing” (which is a date and a mutually agreed upon scheduled time).